Insurance Chabot

The comprehensive assistant is capable of guiding and informing clients with all the information they need, precisely when they need it.

Try Our Insurance Chatbot

Ready to Create Your Insurance Chatbot?

Streamline your insurance operations with AI-powered assistance.

Create Your ChatbotClaims Processing

Automate claims processing and provide real-time status updates to customers.

Policy Information

Instantly provide detailed policy information and coverage explanations.

24/7 Support

Provide round-the-clock assistance for customer inquiries and emergencies.

Features

Improve Agent Productivity

With a bot providing support, agents no longer need to spend time on routine tasks, allowing them more time to work with other clients and solve complex problems.

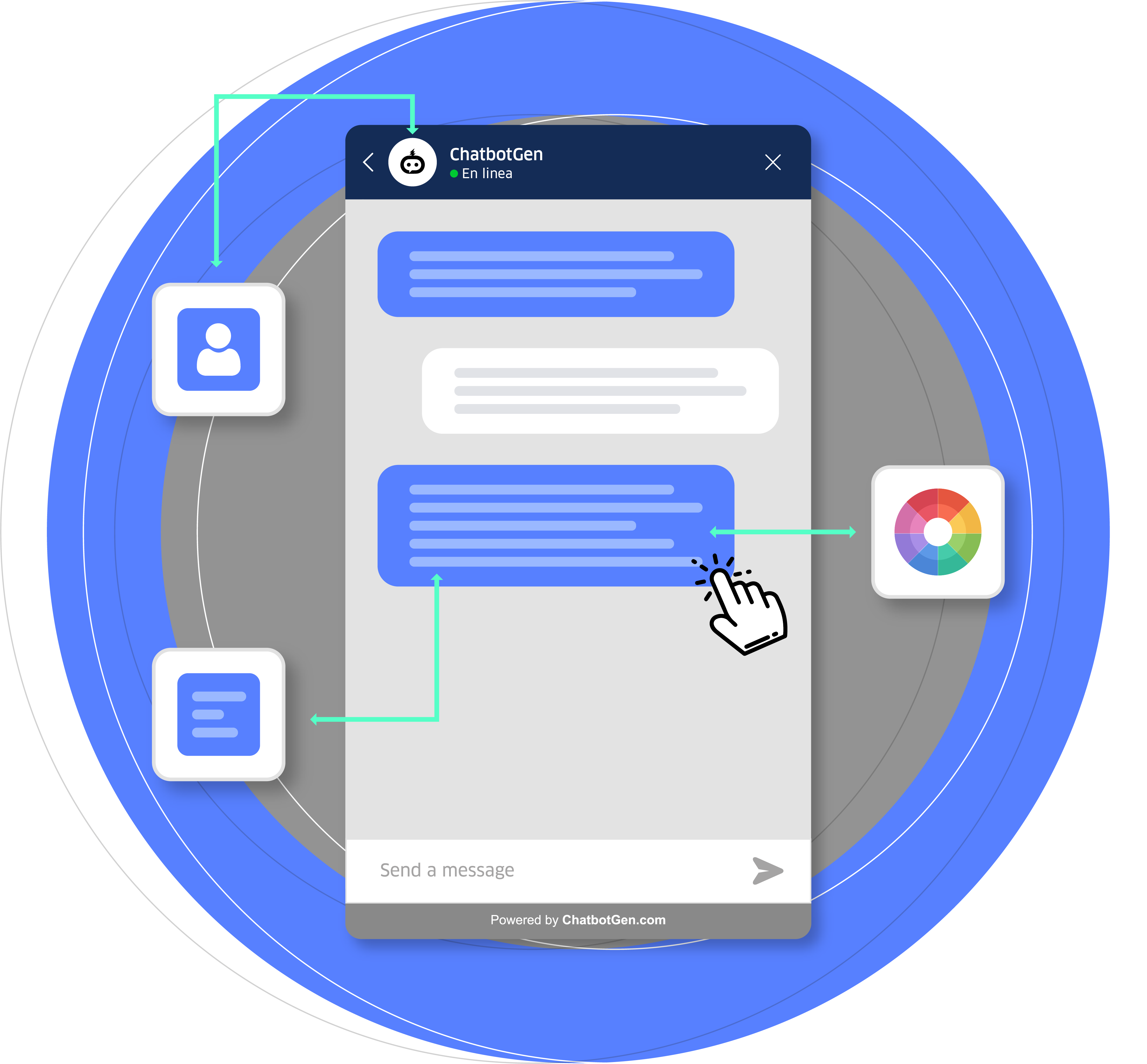

Custom interface

Modify the style, colors, placeholders, suggested messages, and more to personalize the interface.

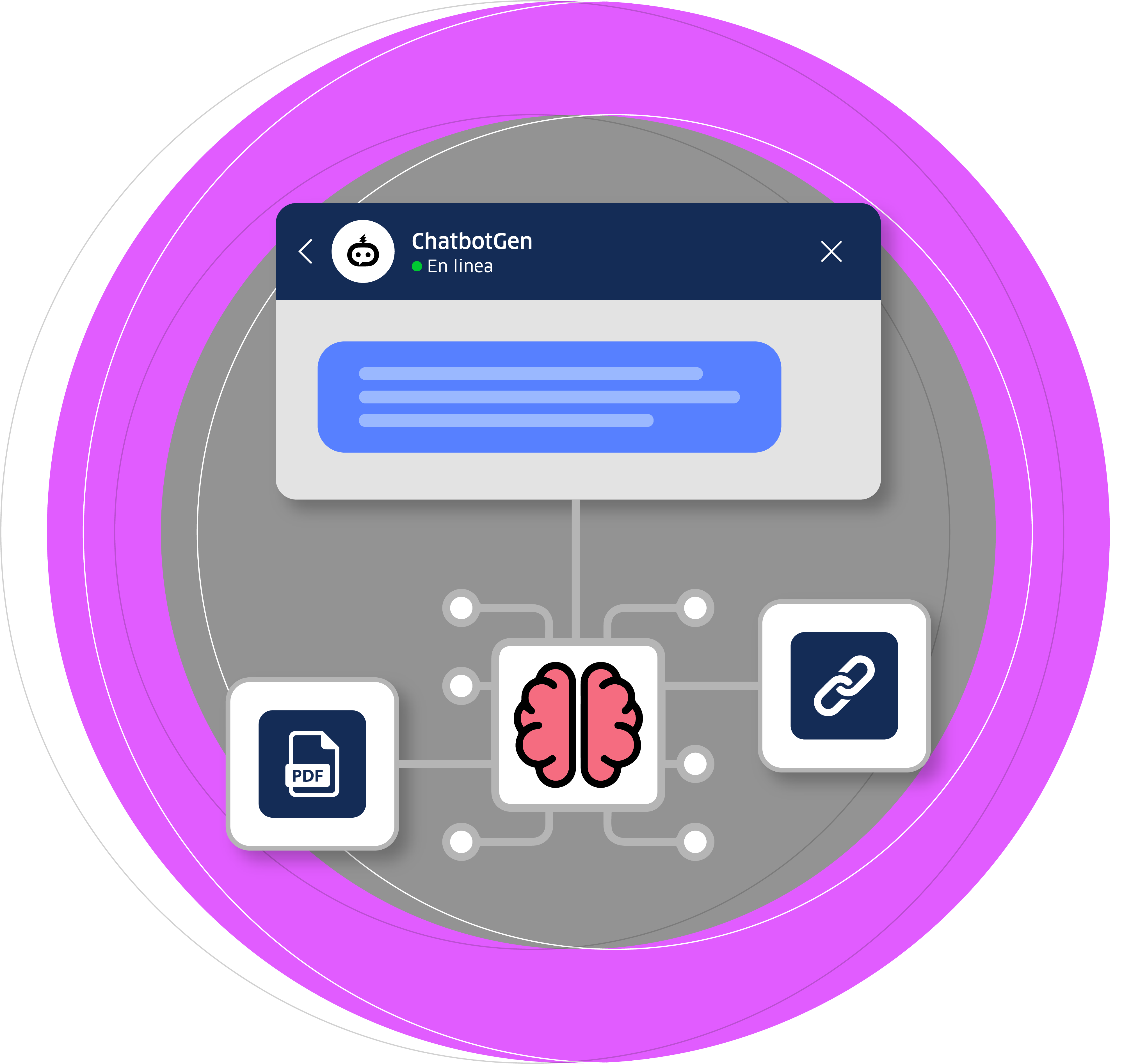

Multi-source learning

Feed the bot with documents and links to access a broader range of information.

Integrate dynamic forms

These forms take parameters and send requests to an external API, allowing our bot to provide the most accurate interpretation of the results.